How Do You Know if It Is Debit or Credit

If there's one piece of bookkeeping jargon that trips people upwards the most, it's "debits and credits."

What exactly does it mean to "debit" and "credit" an account? Why is it that debiting some accounts makes them go up, but debiting other accounts makes them go downwardly? And why is any of this important for your business?

Here's everything you need to know.

What are debits and credits?

In a nutshell: debits (dr) record all of the money flowing into an account, while credits (cr) tape all of the money flowing out of an account.

What does that hateful?

Most businesses these days use the double-entry method for their accounting. Nether this system, your entire business is organized into private accounts. Recollect of these every bit private buckets full of money representing each aspect of your company.

For case:

-

I bucket might correspond all of the greenbacks you accept in your business bank account (the "cash" saucepan)

-

Another saucepan might represent the full value of all the furniture your business concern has in its function (the "furniture" bucket)

-

Another saucepan might represent a banking company loan yous recently took out (the "bank loan" bucket)

When your business does anything—buy furniture, take out a loan, spend coin on research and development—the amount of coin in the buckets changes.

Recording what happens to each of these buckets using full English sentences would be tedious, then we need a shorthand. That's where debits and credits come in.

When money flows into a bucket, nosotros record that every bit a debit (sometimes accountants volition abbreviate this to just "dr.")

For example, if you deposited $300 in cash into your business organization banking company account:

An auditor would say we are "debiting" the cash bucket past $300, and would enter the following line into your bookkeeping system:

| Business relationship | Debit | Credit |

|---|---|---|

| Greenbacks | $300 |

When money flows out of a bucket, we record that every bit a credit (sometimes accountants will abbreviate this to just "cr.")

For case, if you withdrew $600 in cash from your business bank account:

An accountant would say you are "crediting" the cash bucket by $600 and write down the following:

| Account | Debit | Credit |

|---|---|---|

| Greenbacks | $600 |

Debits and credits in action

In that location's i thing missing from the examples above. Money doesn't just disappear or appear out of nowhere. It has to come up from somewhere, and go somewhere.

That's what credits and debits allow you come across: where your money is going, and where it's coming from.

Let's say that one day, you visit your friend'southward startup. After taking a tour of the part, your friend shows you lot a beautiful ergonomic continuing desk-bound. You've been looking for this model for months, merely all the article of furniture stores are sold out. Your friend ordered an extra one, and she can sell it to you for cheap. You agree to purchase it from her for $600.

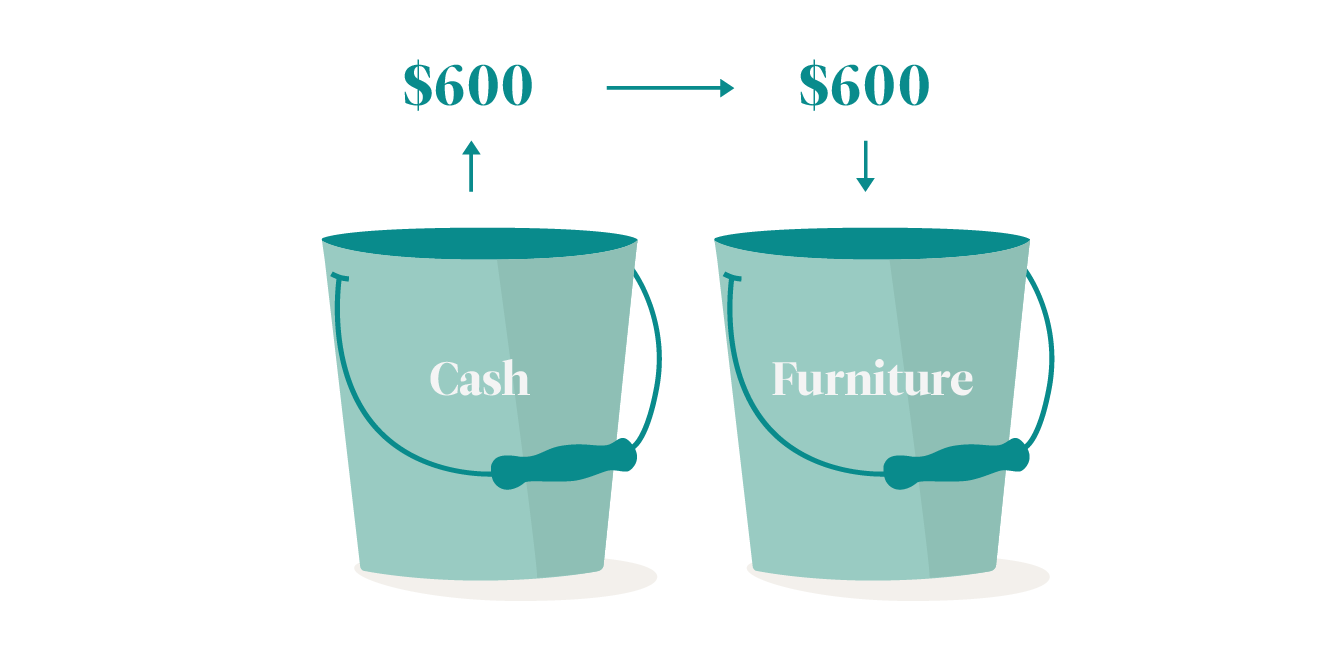

Hither'south what that would expect like using our bucket organisation. First, we motility $600 out of your greenbacks saucepan.

Just like in the above section, nosotros credit your cash account, because coin is flowing out of it.

But this isn't the just saucepan that changes. Your "furniture" bucket, which represents the total value of all the piece of furniture your company owns, too changes.

In this example, it increases by $600 (the value of the chair).

You debit your article of furniture account, considering value is flowing into it (a desk-bound).

In double-entry bookkeeping, every debit (inflow) always has a corresponding credit (outflow). And so we record them together in 1 entry.

In this case, the entry would be:

| Account | Debit | Credit |

|---|---|---|

| Piece of furniture | $600 | |

| Cash | $600 |

An auditor would say that nosotros are crediting the bank account $600 and debiting the furniture business relationship $600.

How debits and credits affect liability accounts

The two buckets we used in the higher up case—cash and furniture—are both nugget buckets. (That is, they keep track of something yous own.)

Just not all buckets are asset buckets. Some buckets continue track of what you owe (liabilities), and other buckets go along track of the full value of your business organisation (equity).

Let'southward imagine that later buying that expensive desk-bound, yous want to get some extra cash for your business organisation. So you accept out a $1,000 bank loan, and you lot increase (debit) your cash business relationship by $1,000.

At present here's the tricky office.

In add-on to adding $1,000 to your cash bucket, we would likewise have to increase your "bank loan" bucket by $one,000.

Why? Because your "bank loan saucepan" measures not how much you lot have, but how much y'all owe. The more than y'all owe, the larger the value in the banking concern loan saucepan is going to be.

In this instance, nosotros're crediting a bucket, merely the value of the bucket is increasing. That's because the saucepan keeps rail of a debt, and the debt is going up in this case.

An auditor would tape that the following fashion:

| Account | Debit | Credit |

|---|---|---|

| Cash | $1,000 | |

| Bank Loan | $1,000 |

How debits and credits bear upon equity accounts

Let'south practise one more than instance, this time involving an disinterestedness account.

Allow's say your mom invests $i,000 of her ain cash into your visitor. Using our bucket system, your transaction would await like the following.

Showtime, your greenbacks account would go upwardly by $i,000, considering you at present have $1,000 more from mom.

Just that's not the just saucepan that changes. You mom now has a $ane,000 equity stake in your business—and so the bucket labelled "equity (Mom)" also increases by $one,000:

An accountant would tape that the post-obit way:

| Account | Debit | Credit |

|---|---|---|

| Cash | $ane,000 | |

| Disinterestedness (Mom) | $i,000 |

Why is it that crediting an disinterestedness account makes it go up, rather than down? That'south because equity accounts don't measure how much your business concern has. Rather, they measure all of the claims that investors have confronting your business concern.

The Disinterestedness (Mom) bucket keeps track of your Mom'south claims against your concern. That's her equity, not your business organization'south. In this case, those claims have increased, which means the number inside the bucket increases.

Debits and credits chart

Nearly people will apply a listing of accounts then they know how to record debits and credits properly.

A cheat sheet like this is an piece of cake fashion to think debits and credits in accounting:

| Debit | Credit |

|---|---|

| Increases an asset account | Decreases an asset account |

| Increases an expense account | Decreases an expense account |

| Decreases a liability account | Increases a liability account |

| Decreases an equity account | Increases an equity account |

| Decreases revenue | Increases revenue |

| Always recorded on the left | Always recorded on the right |

And if that's too much to remember, just retrieve the words of accountant Charles Eastward. Sprague:

"Debit all that comes in and credit all that goes out."

What's Demote?

We're an online accounting service powered past real humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable modest business experts. We're here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Get started with a free month of accounting.

This mail service is to exist used for informational purposes only and does not constitute legal, business, or revenue enhancement communication. Each person should consult his or her own attorney, business organisation advisor, or tax advisor with respect to matters referenced in this postal service. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Source: https://bench.co/blog/bookkeeping/debits-credits/

0 Response to "How Do You Know if It Is Debit or Credit"

Postar um comentário